kentucky income tax calculator

On the next page you will be able to add more details like itemized deductions tax credits capital gains and more. The Federal Income Tax is a marginal income tax collected by the Internal Revenue Service IRS on most types of personal and business income.

Tax Withholding For Pensions And Social Security Sensible Money

The income tax system in Puerto Rico has 5 different tax brackets.

. North Dakotas maximum marginal income tax rate is the 1st highest in the United States. Your household income location filing status and number of personal exemptions. Income is counted for you your spouse and everyone youll claim as a tax dependent on your federal tax return if the dependents are required to file.

We estimate your Social Security income using your stated annual income and assuming you have worked and paid Social Security taxes for 35 years prior to. Your income tax must be paid throughout the year through tax withholding or quarterly payments and. The Arkansas income tax has four tax brackets with a maximum marginal income tax of 660 as of 2022.

Your average tax rate is 165 and your marginal tax rate is 297. Like the Federal Income Tax Idahos income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. We do our best to ensure that all of our tax rates are kept up to date - but if.

The individual income tax rate in Puerto Rico is progressive and ranges from 0 to 33 depending on your income. The Earned Income Tax Credit or EITC is a refundable tax credit for lower to middle income working families that is largely based on the number of qualifying children in your household. 41110 for taxable year 2017 and earlier The.

Include their income even if they dont need health coverage. Kansas maximum marginal income tax rate is the 1st highest in the United States ranking directly. Learn more about estimating income and see what to include.

Kansas collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Local Income Tax Rates in Kentucky Choose any locality for details. The Georgia income tax has six tax brackets with a maximum marginal income tax of 575 as of 2022.

You can use our free Arkansas income tax calculator to get a good estimate of what your tax liability will be come April. How Income Taxes Are Calculated. Like the Federal Income Tax North Dakotas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Income Tax Calculator. Like the Federal Income Tax Kansas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. To better align with filing season tax calculations are based on the tax filing calendar therefore calculations prior to April are based on the previous years tax rules.

Real estate in Kentucky is typically assessed through a mass appraisal. After a few seconds you will be provided with a full breakdown of the tax you are paying. The Kentucky income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022.

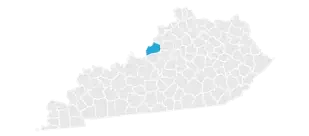

You can use our free Kentucky income tax calculator to get a good estimate of what your tax liability will be come April. The median annual property tax payment in the county is just 1768. New York collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

All of our bracket data and tax rates are updated yearly from the IRS and state revenue departments. You may use the worksheet in the Schedule P instructions or you may use the Schedule P calculator to determine your exempt percentage. Idaho collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

On the next page you will be able to add more details like itemized deductions tax credits capital gains and more. Learn More About Income Taxes. This income tax calculator can help estimate your average income tax rate and your take home pay.

For instance an increase of 100 in your salary will be taxed 3955 hence your net pay will only increase by 6045. Our income tax calculator calculates your federal state and local taxes based on several key inputs. This marginal tax rate means that your immediate additional income will be taxed at this rate.

The Federal Income Tax. Marketplace savings are based on your expected household income for the year you want coverage not last years income. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Qualified children for the EITC must be dependants under age 19 full-time dependant students under age 24 or fully disabled children of any age. Our income tax calculator calculates your federal state and local taxes based on several key inputs. 1 of each year.

Print Income Tax Forms. North Dakota collects a state income tax at a maximum marginal tax rate of spread across tax brackets. This marginal tax rate means that your immediate additional income will be taxed at this rate.

You can use our free Georgia income tax calculator to get a good estimate of what your tax liability will be come April. To use our Virginia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Property taxes in Kentucky follow a one-year cycle beginning on Jan.

Thats the assessment date for all property in the state so taxes are based on the value of the property as of Jan. Including the right people in your household. If you received a Kentucky income tax refund last year were required by federal law to send Form 1099-G to you to remind you that the state refund must be.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Both the sales and property taxes are. Many states do not release their current-tax-year 2021 brackets until the beginning of the following year and the IRS releases federal tax brackets for the current year between May and December.

Idahos maximum marginal income tax rate is the 1st highest in the United States ranking directly. Count yourself your spouse if youre married plus everyone youll claim as a tax dependent including those who dont need coverage. How many income tax brackets are there in Puerto Rico.

The Whatcom County average effective property tax rate is 085 compared to the Washington State average of 093. Using our Virginia Salary Tax Calculator. Income Taxes By State.

On the next page you will be able to add more details like itemized deductions tax credits capital gains and more. Your household income location filing status and number of personal exemptions. Your average tax rate is 212 and your marginal tax rate is 396.

Whatcom County sits in the northeast corner of Washington State along the Canadian Border. To use our California Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. It has property tax rates well below the state average.

Like the Federal Income Tax New Yorks income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. This breakdown will include how much income tax you are paying state taxes. New Jersey state income tax rate table for the 2022 - 2023 filing season has seven or eight income tax brackets with NJ tax rates of 14 175 245 35 5525 637 897 1075.

Use our income calculator to make your best estimate. Kentucky Property Tax Rules. Kentucky has a flat income tax rate of 5 a statewide sales tax of 6 and property taxes that average 1257 annually.

2022 New Jersey tax brackets and rates for all four NJ filing statuses are shown in the table below. For instance an increase of 100 in your salary will be taxed 2965 hence your net pay will only increase by 7035. Learn more about who to include in your household.

New Yorks maximum marginal income tax rate is the 1st highest in the United States ranking directly. This breakdown will include how much income tax you are paying state taxes. Using our California Salary Tax Calculator.

The federal income tax consists of six marginal tax brackets ranging from a minimum of 10 to a maximum of 396.

Kentucky Income Tax Brackets 2020

Kentucky State Ifta Fuel Tax File Ifta Return Online Ifta Tax

Where S My Refund Kentucky H R Block

Kentucky Sales Tax Small Business Guide Truic

Kentucky Sales Tax Guide And Calculator 2022 Taxjar

Kentucky Property Tax Calculator Smartasset

Income Tax Calculator Estimate Your Refund In Seconds For Free

Payroll Calculator Free Employee Payroll Template For Excel

Kentucky Income Tax Calculator Smartasset

How To File The Inventory Tax Credit Department Of Revenue

Kentucky Retirement Tax Friendliness Smartasset

Sales Tax On Grocery Items Taxjar

Kentucky Income Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Kentucky Income Tax Calculator Smartasset

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free